Global IPO trends: Q1 2019 | Page 3Global IPO trends: Q1 2019 | Page 3Global IPO marketGlobal IPO momentum slows but Q2 2019 set to rebound

Global IPO trends: Q1 2019 | Page 3Global IPO trends: Q1 2019 | Page 3Global IPO marketGlobal IPO momentum slows but Q2 2019 set to reboundWhile Q1 is usually a quiet IPO quarter, in 2019 we’ve seen IPO markets sent into a cautious wait-and-see mode as a number of factors collide. The dense fog of geopolitical tensions, trade issues among the US, China and Europe, as well as uncertainty as to how the UK will leave the EU, slowed down IPO activity in all regions. As we look to Q2 2019, we only need a successful mega IPO or unicorn from the robust IPO pipeline for the fog of uncertainty to clear and global IPO markets to spring into blooom.

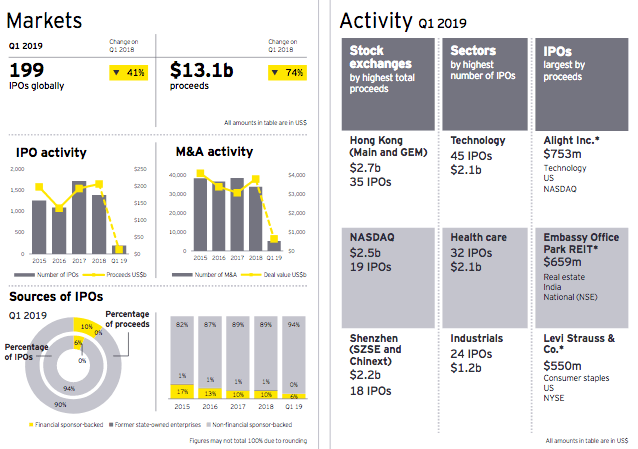

Historically, Q1 is a quiet quarter across IPO markets. However, Q1 2019 has been unusually quiet. Ye a r-over-year volumes are down 41%, while year-over-year proceeds are down 74%. In Q1 2019, 199 companies launched IPOs, raising US$13.1b. Although IPO activity was slower across all regions, pipelines remain strong with unicorns and mega deals. ►Asia-Pacific continued to dominate global IPO activity by deal numbers in Q1 2019, despite the prevailing geopolitical uncertainty and trade tensions. This region’s share of global IPO activity stood at 63% by deal numbers and 64% by proceeds. However, this region saw its IPO activity decline of 24% by deal number and 30% by proceeds in Q1 2019 compared with Q1 2018.►EMEIA exchanges saw 65% drop in deal volume and 93% decline by proceeds in Q1 2019 compared with Q1 2018.A still unclear path to Brexit, US trade and tariff uncertainties, risks of slower economic growth and economic challenges in three of Europe’s largest economies continued to have a direct impact on EMEIA and European IPO activity. ►Americas saw a 44% decline by deal number and 83% decline by proceeds in Q1 2019 compared with Q1 2018. The longest US Government shutdown in the country’s history effectively sent the US IPO markets into near hibernation for the first two months of 2019. The US accounted for 65% of Americas’ IPOs and 92% by proceeds. ►Technology, health care and industrials saw the largest share of IPOs in Q1 2019, while technology, health care and financials led by proceeds. This indicates that investors continue to strike a balance between growth and value investments.►Cross-border activity levels were lower in Q1 2019, representing only 7% of global IPO activity. The one exception was EMEIA, which remained constant compared to 2018. Cross-border IPOs accounted for 9% of EMEIA companies’ IPO activity in Q1 2019. ►Non-financial sponsored companies represented 94% of global IPOs in Q1 2019. Ongoing uncertainties and volatility in global equity markets has an increasing number of financial sponsors considering M&A as a preferred exit route. However, M&A numbers are also off to a slower start in 2019.

Related news

AI is also transforming taxation

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

(HU) METRO Gasztro Fesztivál a SIRHA Budapesten – Élmény, inspiráció és valódi megoldások a HoReCa-szakmának

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >