BIEF Office Market Summary for the Second Quarter of 2025

The Budapest Real Estate Advisory Forum (BIEF, BRF) – comprising CBRE, Colliers, Cushman & Wakefield, Eston International, iO Partners and Robertson Hungary – hereby publishes its office market summary for the second quarter of 2025.

The total modern office stock in Budapest currently amounts to 4,426,050 m2, of which 3,548,815 m2 of modern speculative office space in categories “A” and “B” and 877,235 m2 of owner-occupied office space. Within the speculative stock, category “A” office space represents 67%, while category “B” space represents 33%.

The total modern office stock in Budapest currently amounts to 4,426,050 m2, of which 3,548,815 m2 of modern speculative office space in categories “A” and “B” and 877,235 m2 of owner-occupied office space. Within the speculative stock, category “A” office space represents 67%, while category “B” space represents 33%.

No new modern office space was handed over in Budapest in the second quarter of 2025, so the total office stock remained unchanged compared to the previous quarter.

During the second quarter, 22,935 m2 of speculative office space was reclassified from speculative stock, thus the size of owner-occupied offices increased to 877,235 m2.

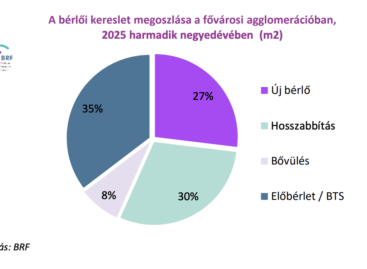

Total demand in the second quarter of 2025 amounted to 119,975 square meters, which is a 16% decrease compared to the same period of the previous year. Within the total demand, contract extensions had a share of 39%. New contracts accounted for 40% of leases, expansions only 2%, and the share of purchases for own use reached 19%. No pre-lease contracts were registered in the quarter.

Net demand (transactions without contract extensions and ownership) amounted to 49,955 m2 in this period, which represents a 21% decrease compared to Q2 2024.

The vacancy rate in Q2 2025 stood at 12.8%, which represents a 1.29 percentage point decrease compared to the previous quarter and a 1.18 percentage point decrease compared to the same period of the previous year. In Q2 2025, the lowest vacancy rate was recorded in the Buda Center submarket (7.4%), while the highest value was still measured in the Agglomeration (19.4%).

Net absorption turned positive with 57,000 m2.

The highest tenant activity in Q2 2025 was recorded in the Váci út office corridor submarket, where 37% of the total volume was booked. The second highest activity was recorded in South Buda, which accounted for 22% of the quarterly leasing volume.

BRF recorded a total of 136 leases in the second quarter with an average size of 882 m², which shows a decrease in the number of transactions compared to the same period of the previous year, while the average size remained almost unchanged. The largest speculative transaction of the quarter was an extension, which was closed in the Váci út office corridor submarket for 13,800 square meters. The largest new lease was signed for an area of 12,500 m2, also in the Váci út office corridor.

Related news

The capital and its surroundings have been expanded with a significant new industrial and logistics area

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The industrial real estate market is characterized by stabilizing demand and moderate expansion

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The Hungarian Food Book is 50 years old

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >ZEW: Economic expectations worsened in Germany and the euro area in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NKFH: inspections focus on discount prices and customer deception

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >