Where to invest in 2017

Amid a dense fog of uncertainty, an aging bull will have to find its footing in 2017. Rarely has the way forward been so obscured by the murky policies of a new political regime, as well as by questions about economic growth, monetary policy and the animal spirits — or lack thereof — of America's corporate chieftains.

Whether the bull finds its way safely will depend on how well markets adjust to the new reality in Washington and whether they can make a transition from being driven by ultra-easy Federal Reserve policies to being supported by what in the end must support all bull markets: rising profits across a broad swath of corporate America. The stock market has been meandering for a year and a half, searching for direction.

Unfortunately, we don't expect a lot of clarity in 2017, at least initially. A Republican sweep of the executive and legislative branches of government argues for substantive changes in government spending, trade, tax and immigration policies. Volatility will be on the rise as investors try to figure out the impact on the economy and financial markets.

For now, it's reasonable to expect returns in the mid-single digits in 2017 based on an improving economy and a resumption of earnings growth. But stocks could end the year wide of the mark in either direction. We see Standard & Poor's 500-stock index ( .SPX

Loading… Loading…

) finishing 2017 in the range of 2200 to 2250, suggesting a return of 4% to 6%, including dividends. Figure the Dow Jones industrial average ( .DJI

Loading… Loading…

) landing near 19,500. (The indexes closed at 2163 and 18,590, respectively, on November 9; all prices and returns in this article are through that date.)

Against a backdrop of change unfolding within an essentially sound economy, you'll do best by favoring stocks over bonds, zeroing in on companies with strong long-term growth trends and rising dividends, and by finding sectors that will prosper with Donald Trump in the White House. Although in recent years it has paid to focus on U.S. stocks, a combination of low returns and high volatility will remind investors of the importance of a well-diversified portfolio. That means looking for opportunities overseas.

For the market to deliver even modest gains, the graying U.S. economic expansion — like the bull market, turning eight in 2017 — must soldier on. Kiplinger expects gross domestic product to expand by 2.1% in 2017, up from an expected 1.5% in 2016. “Economies don't die of old age, they die of excesses — overbuilding, overconfidence, overspending,” says John Canally, chief economist at brokerage and advisory firm LPL Financial. Far from excessive, substantial outlays from Uncle Sam or from corporate CEOs have been sorely lacking throughout most of the recovery, and that has kept a lid on growth.

That could change in 2017 — big league, as Trump might say. Government spending to upgrade the nation's roads, bridges, airports and other infrastructure is a top priority for Trump and is supported by both political parties; Trump has also promised to boost defense spending. With the unemployment rate expected to close 2017 at a low 4.6% rate (compared with 4.9% in late 2016), companies will have little choice but to spend on plants and equipment to continue growing.

Says Brad McMillan, chief investment officer of Commonwealth Financial Network, a brokerage firm: “If I'm a company, I can hire bodies or buy equipment to make bodies more efficient. But I'm starting to run out of bodies.” Trump's campaign vow to crack down on immigration could exacerbate labor shortages. Meanwhile, consumers, whose spending accounts for 70% of the domestic economy, are in good shape. Household balance sheets are healthy, wages are starting to rise, and promised tax cuts could make many people feel even wealthier. “Many of Trump's policies would stimulate the economy and could lead to faster growth in the short term,” says McMillan.

But risks abound. Since 1929, nine of 14 U.S. economic recessions began in the year following the presidential election. New presidents want the bad news of a recession or a bear market over with as early as possible in their four-year terms, says James Stack, publisher of InvesTech Research newsletter. “This time around, interest rates are subdued and the economy appears sound,” says Stack. Nonetheless, tighter monetary policy and controversial moves tend to land earlier rather than later in the presidential cycle, he says. Trump's protectionist tendencies are particularly worrisome, says Alan Levenson, T. Rowe Price's chief U.S. economist. “I am not aware of any country in history that ever isolated its way to prosperity,” he says.

An inflationary theme also runs through the new president's agenda. A combination of tax cuts and government spending sprees could ramp up budget deficits, and a push to return immigrants to their home countries or to increase trade tariffs would boost wages and the prices of foreign-made goods. Inflation was already set to rise in 2017, with higher oil prices offsetting moderating food prices. So-called core inflation, which excludes volatile food and energy prices but includes rents, medical care and education costs, is drifting higher, too. Expect consumer prices to climb by a moderate 2.4% in 2017, up from an expected 1.8% rise in 2016.

The Federal Reserve is likely to respond with one or two quarter-percentage-point hikes in short-term interest rates in 2017 (on top of an increase expected in December 2016). That's barely enough to qualify as a tightening of monetary policy, but it could still take some getting used to. “Getting interest rates back up will be a plus for the economy because of the additional returns for savers,” says McMillan. “But there could be a couple of rocky quarters while the market and the economy sort it all out.” Look for yields on 10-year Treasury bonds to drift up to 2.5%, from 2.1% recently, by the end of 2017. Investors who want to protect their portfolios from rising inflation should consider buying Treasury inflation-protected securities directly from Uncle Sam.

Despite what is sure to be a fixation on Trumpolitics, the new administration's policies are likely to wind up as “Trump Lite,” says David Kelly, chief global strategist at J.P. Morgan Asset Management. Expect less gridlock with Trump's party in control of both houses of Congress, but establishment Republicans won't rubber-stamp dramatic reversals in trade and fiscal policies, and Trump himself has shown a willingness to compromise. “He's strident on the campaign trails, but I think he'll be pragmatic in office,” says Kelly.

Related news

Related news

Amikor a megszámlálhatatlan megszámlálhatóvá válik

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The number of Hungarian dishes has increased to one hundred with the terpertős pogácsa and Vecsés sauerkraut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

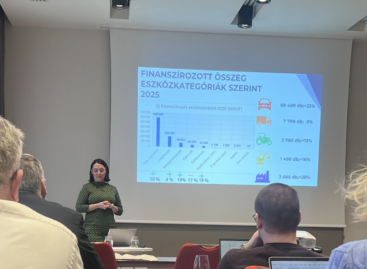

Read more >The leasing market was able to grow last year in a stable environment

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >