Magazine: The Trade Parliament was in session (Part 1)

This year our magazine organised the Business Days conference in Tapolca under the name Trade Parliament, between 16 and 20 September. A record-breaking 750 FMCG experts and decision-makers came to learn about the latest facts, trends and results, also participating in channel-specific roundtable discussions. Climate change, sustainability and environmental protection were given special attention this year. On the 0th day of the conference we approached the topic from the food industry’s perspective.

Trade magazin’s editor-in-chief Zsuzsanna Hermann welcomed participants and gave the floor to climate expert Dr István Bart, who is also founder and director of the Climate Strategy 2050 Institute.

Szilvia Krizsó, communications consultant (left) and Zsuzsanna Hermann,

managing director and editor-in-chief of Trade Magazin (right)

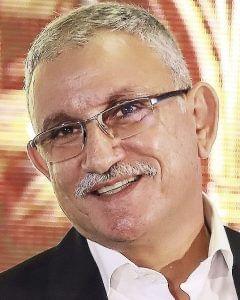

István Bart

founding director

Climate Strategy

2050 Institute

He told that the climate change can’t be prevented and called attention to the fact that if we don’t want the temperature increase to go above 2°C, we must start cutting greenhouse gas emission instantly. For instance emission in Europe should reduce to zero by 2050. Mr Bart thinks that companies can contribute to climate protection by assessing the risks of disasters, the market and regulations, and changing the current practices with the help of investments and awareness raising activities.

Miklós Nagy

secretary general

CSAOSZ

Miklós Nagy, secretary general of the Hungarian Association of Packaging and Materials Handling (CSAOSZ) gave a presentation about how various kinds of packaging can prevent environmental pollutions. He talked about microplastics and the harm they are doing – rivers, lakes and oceans are full of them already.

Paolo Bray

president, WSO

Paolo Bray, president of the WSO Group had launched the Friend of the Sea certification programme in 2008, which was followed by Friend of the Earth in 2016. The two schemes popularise the products that come from sustainable fisheries and agriculture. Mr Bray underlined that it is also important for Hungarian companies to start using certifications, as eco-labels matter more and more to shoppers.

Roman Postl

sales director

TOMRA

Roman Postl, sales director of TOMRA in Austria, Croatia and Eastern Europe introduced the system of beverage container collection and recycling, from the perspective of the circular economy. He mentioned that every year 8 million tons of plastic ends up in the oceans, as every minute we use and throw away 1 million plastic bottles; by 2022 this number will rise to 1.2 million. The sales director introduced the results of TOMRA’s reverse vending machine pilot project, which showed people aren’t motivated for voluntary plastic bottle returning – the project failed in the United Kingdom, the Netherlands, Belgium, France and Spain. He also mentioned good examples from Romania, Slovakia and Lithuania, and talked about the society’s positive reaction to clean loop recycling.

Ildikó Balázs

head of corporate affairs

Auchan

The programme of the 0th day continued with a roundtable discussion, the participants of which shared their thoughts on sustainability. Auchan Hungary’s head of corporate affairs and co-chair of the National Trade Association (OKSZ) Ildikó Balázs spoke about the four pillars of Auchan’s CSR strategy: workers, customers, environment and society. She revealed that they employ nearly 400 disabled people and thanks to its energy use reduction strategy, the company utilises 50 percent less energy for lighting.

Izabella Bauer

sales manager

BS Plastic

Izabella Bauer, sales manager of BS Plastic talked about the programmes they had launched to provide consumers with the information necessary for making the right decisions, e.g. many customers throw away roll-bags because they don’t know that they can be used again.

Gergely Bálint

director of corp. sales

Nestlé

Gergely Bálint, Nestlé’s director of corporate sales told that sustainability forms part of the company’s global strategy. He underlined that so far they had given nutritional advice to 30 million children, and Nestlé had also established a packaging technology centre that focuses on sustainable solutions.

Zoltán Fekete

secretary general

Branded Goods Association

Zoltán Fekete, secretary general of Branded Goods Association Hungary reckons that instead of the current moral panic generating, a rationalistic dialogue and joint acts would be needed. FMCG companies are under pressure because of plastic packaging, but sustainability has a much wider scope.

Ottó Németh

general and

marketing manager

Henkel

Ottó Németh, general and marketing manager of Henkel informed: In comparison with the ecological footprint of its operations, products and service, by 2030 the company will triple the value it produces – Henkel calls this strategy Factor 3.

Nyilas Orsolya

külső kommunikációs

vezető

Coca-Cola HBC

Orsolya Nyilas, external communications lead at Coca-Cola HBC shed light on the fact that they had launched a comprehensive, multi-year plan to solve the problems related to packaging. ‘A World Without Waste’ seeks to collect just as many plastic bottles or aluminium cans as they sell by 2030.

Attila Sófalvi

market director

Mars Hungary

Attila Sófalvi, market director with Mars Hungary said their three pillars of sustainability are renewable resources, improving the living conditions of consumers and helping people along the supply chain.

Réka Szőllősi

managing director

FÉSZ

Réka Szőllősi, managing director of the Federation of Responsible Food Manufacturers (FÉSZ) and leader of the Hello Food programme said: Consumers aren’t the most concerned with E-numbers any more, they are more interested in packaging waste issues.

Csilla Zombory

head of quality

and environmental management

SPAR

Csilla Zombory, head of quality and environmental management with SPAR also stressed the importance of educating consumers, for instance often they don’t understand why plastic shopping trolleys are greener than metal ones.

Miklós Vörös

area op. director

TESCO

Miklós Vörös, area operations director of TESCO talked about the company’s food saving programme. In 2018 they donated 7,748 tons of food to charity. By 2025 the company wants to market 100 percent of its private label products in recycled packaging, plus they also intend to cut food waste by 50 percent.

On Tuesday morning members of the Trade Parliament convened again, and Trade magazin’s editor-in-chief and Speaker of the House Zsuzsanna Hermann introduced the chairs of the day, Chain Bridge Club members Dr Gábor Csirszka and Dr Béla Fischer.

dr. Gábor Csirszka (left) and dr. Béla Fischer (right),

Chain Bridge Club members

dr. Imre Porkoláb

colonel

Pentagon

The first speaker of the day was colonel Dr Imre Porkoláb, a representative of NATO and the Pentagon. He spoke about how performance improves 25-30 percent if smaller goals are set. In his view a team can work well if members trust each other, there is chemistry between them, there is a kind of intuition and continuous, open communication.

dr. Zsolt Feldman

secretary of state

Ministry of Agriculture

Dr Zsolt Feldman, secretary of state at Ministry of Agriculture was the next presenter. He told about the performance of the Hungarian agri-food sector that volume sales were up 5 percent in the first half of 2019 and export’s share in the sales growth was more than 7 percent. The sector has been growing since 2013 but the sales revenue, which is a bit below HUF 4,000 billion, is still smaller than that of other sectors. Mr Feldman made it clear: The government can only contribute to the establishment of positive partnership relations if each member of the supply chain is working for the consumers.

Balázs Győrffy

president

NAK

Balázs Győrffy, president of the Hungarian Chamber of Agriculture (NAK) spoke about the network of food industry coordinators they had built one year ago, and stressed the importance of innovation work. In connection with the conflicts with retail chains, he told that NAK managed to solve the problems in an exemplary fashion. NAK’s soon-to-be-launched ‘Read the label!’ campaign seeks to increase consumer consciousness.

Tamás Éder

president

FÉSZ

Tamás Éder, president of the Federation of Responsible Food Manufacturers (FÉSZ) expressed his optimism concerning the Hungarian food industry’s performance in 2019. He reckons that strengthening domestic sales in the last year and a half can be the sign of a lasting positive trend. For the first time in almost 20 years domestic sales by Hungarian food companies grew more than the average growth rate in food retail sales.

László Krisán

CEO

KAVOSZ

László Krisán, CEO of KAVOSZ and president of the retail department of the National Association of Entrepreneurs and Employers (VOSZ) introduced the work VOSZ does in the international organisation EuroCommerce, which unites 150 trade associations from 31 countries. Next he spoke about the changing shopping habits and the new retail trends emerging because of the transformation.

After the presentations Szilvia Krizsó was the moderator of the award ceremony where the ‘Retailers Award of Excellence for Hungarian Products in 2019’ was presented. Representing the founders, Dr Zsolt Feldman, secretary of state at the Ministry of Agriculture, Eszter Benedek, managing director of Hungarian Product Nonprofit Kft. and Zsuzsanna Hermann, Trade magazin’s managing director and editor-in-chief presented the awards to the winner CO-OP Hungary Zrt., runner-up SPAR Magyarország Kereskedelmi Kft. and 3rd-placed Auchan Retail Magyarország Kft. Special awards were given to SPAR Magyarország Kereskedelmi Kft., CBA Kereskedelmi Kft. and Penny Market Kft.

Ildikó Balázs

co-president

OKSZ

In the afternoon Dr Gábor Csirszka was the moderator and work started with Ildikó Balázs’ presentation, who represented Auchan as head of corporate affairs and the National Trade Association (OKSZ) as co-president. She analysed the challenges ahead of FMCG retail in Hungary and revealed: Now that Hungarians earn more, they don’t spend their extra income on buying more products, they are purchasing higher-quality goods instead. She underlined the fact that the good old trading models don’t work anymore, so currently market players are experimenting with developing their own way of operation.

Erik Vágyi

sales director

Nielsen

Erik Vágyi, sales director of Nielsen presented the results of a survey (large-sample quantitative and focus group qualitative) made exclusively for the Business Days conference. He told that Hungary’s 7.7-percent FMCG sales growth is very good even at a European level. Food categories performed better in both value and volume; in the drug category the volume sales growth slowed down considerably. As for retail channels, discount supermarkets continued their conquest, and small independent shops managed to grow in value by 8.2 percent.

Andrea Harcos

research director

Kantar-Hoff mann

Andrea Harcos, qualitative research director of Kantar-Hoffmann shared the results of a qualitative survey on shopper personality types, conducted exclusively for the Trade Parliament. The NeedScope model – 12 shoppers were asked to observe themselves while shopping, and there was also a focus group study with 23-52 year old shoppers living in Budapest – differentiated between 6 personality types, which were marked with colours, e.g. red shoppers are daring and shopping quickly, purple ones are confident and assertive, etc.

Tibor Balogh

managing director, OMV

A roundtable discussion ended the 1st day: Dr Gábor Csirszka was the moderator, and the representatives of retailers and product manufacturers were present, to share their views about the convenience trend and the digitalisation process.

OMV’s managing director Tibor Balogh opined that convenience retail is developing dynamically and offering a supermarket-type product selection to customer generates a considerable profit for filling stations.

Szabolcs Forgó

business development director

Patika Management

Szabolcs Forgó, business development director of Patika Management explained that pharmacies will always remain a place that customers trust, making them a very valuable distribution point.

Zsolt Gyelán

vice president

CBA

Zsolt Gyelán, vice president of CBA told: Privately owned small shops with a small product selection that are operated in an outdated fashion will disappear by 2022.

Péter Gyúrós

business development

director

Shell Hungary

Péter Gyúrós, Shell Hungary’s business development director agreed with what Mr Balogh said about the convenience trend, and added that filling stations experience growing demand for fast food. In his view different motor fuels will exist in parallel in the market for a long time.

Tamás Jenei

director of commerce

HELL Energy

HELL ENERGY’s director of commerce Tamás Jenei expressed his opinion that there is great potential in the 15,000 convenience store that exist today. He added that their 100-percent Hungarian-owned company can be the market leader in 10 countries because it has clear core values.

Richárd Kalmár

regional sales director

Auchan

Richárd Kalmár, regional sales director with Auchan said that in spite of the current convenience trend, stores with a large floor space will survive in the long run, because their customers are loyal and the seasonal buying occasions are still very strong – these don’t work without a large floor space.

János Mezei

executive board member

CO-OP Hungary

János Mezei, a member of CO-OP Hungary’s executive board talked about how Hungarian-owned retail chains can really profit from the current ‘buy Hungarian’ attitude of consumers. He is proud of the fact that COOP is the most dynamically developing Hungarian retail chain.

György Sóskuti

corporate sales director

Bonafarm Group

György Sóskuti, corporate sales director of Bonafarm Group reckons that the convenience trend is basically about premiumisation. The market is creating value and the group represents this in meat processing – they care about both animal welfare and making quality products for consumers.

Zsolt Szalay

managing director

Spar

Zsolt Szalay, managing director of SPAR talked about the huge shopper demand for fresh products, and introduced the work done in their new production plant, where already more than 50 high-quality convenience products are made.

László Szili

commercial

director

Reál

László Szili, commercial director of Reál explained that the convenience trend and the purchasing power growth killed lower-quality products in the private label segment. At the same time sales of Reál stores located in small towns and villages suffer from the fact that many consumers move to the cities.

dr. Gábor Karsai

deputy CEO

GKI Economic Research Zrt.

On the 2nd day, Wednesday, the focus was on wholesalers, retail chains in Hungarian ownership, franchise networks and national tobacco shops. Dr Gábor Karsai, deputy CEO of GKI Economic Research Zrt. was the first speaker. He revealed that the Hungarian economy had grown by 5.1 percent in the first half of 2019, which was an exceptionally good performance in the EU. A slowdown is likely to occur in the second half of the year, caused by factors such as less EU funding giving smaller impetus to the Hungarian economy and the world economy performing worse. In 2020 the Hungarian economy is likely to expand by less than 3 percent.

Dr. Michalis Christou

európai vezérigazgató

RetailZoom

Dr Michalis Christou, RetailZoom’s CEO for Europe spoke about Hungarian retail chains and the challenges ahead of them. He thinks that the importance of these chains is underrated, in spite of the fact that their 15,000 stores cover the whole country and realise more than HUF 2,000 billion worth of annual sales. These retail chains are characterised by diversity and they must face challenges such as switching to faster and effective operation.

László Szilágyi

owner

Forward Progress

Consulting

The first roundtable discussion followed the presentations, with the representatives of wholesalers and service providers. László Szilágyi, business coach and owner of Forward Progress Consulting was the moderator.

István N. Szabó

managing director

Z+D

István N. Szabó, managing director of Z + D said that they are looking to the next 3 years with a bit of pessimism. The company plans to invest in substituting human labour with technological solutions.

dr. Richárd Andrejszi

CEO

Chef Market

Dr Richárd Andrejszki, CEO of Chef Market revealed that he expects steady progress in the sector. The company specialises in supplying HoReCa units with products and believes firmly in brand building – which must be done when there is a good economic environment.

László Hovánszky

managing director

METSPA

László Hovánszky, managing director of METSPA opined that consumers must be guided back to brands. He is optimistic about the future, one of the reasons for this is that the reduction in EU funding won’t affect the retail trade sector.

Géza Vincze

head of dry purchasing

METSPA

Géza Vincze, METRO’s head of dry purchasing underlined the fact that innovation plays a vital role in today’s retail trade, the key to success is understanding and satisfying shopper needs, no matter whether we are talking about brands or private label products.

Csaba Kanizsai Tóth

commercial director

Fán Group

Csaba Kanizsai Tóth, Fán Group’s commercial director believes in private label products. He reckons that the globalisation process has started in retail too, only large and stable retailers will survive in the long run. His company supplies HoReCa units and shops smaller than 200m² with products and the company is optimistic about the future in this difficult market.

István Dobi

managing director

Dél-100

István Dobi, managing director of Dél-100 is optimistic too and told: Wholesalers must also help Hungarian enterprises by other means than optimising their product selection.

Noszlopy Zoltán

beszerzési igazgató

CBA

Zoltán Noszlopy, purchasing director of CBA and managing director of PartnerLog expressed his opinion that small independent shops can only remain competitive if the wholesale segment is controlled.

Tamás Gyurta

owner-managing director

Uni-Flock

Uni-Flock’s owner and managing director Tamás Gyurta told that it simplifies and accelerates operations if a single person leads a business. The company works with 3,000-3,500 partners, supplying them with ice cream and frozen products.

Zoltán Házi

CEO

Budapest Wholesale

Market

Zoltán Házi CEO of the Budapest Wholesale Market spoke about the importance of a significant VAT cut in fruit and vegetable retail – in his view there will be no whitening in the market without taking this step. This is the segment where the proportion of the black and the grey markets is the biggest.

Ferenc Szász

business development

director, Mastercard

Ferenc Szász, business development director of Mastercard said that services must be tailored to the needs of customers. He is optimistic about the future as the proportion of electronic payment transactions is growing by 20 percent on a yearly basis.

Dániel Herich

managing director

Marche Logisztika Kft.

Dániel Herich, Marche Logisztika Kft.’s managing director gave a presentation about the company’s innovative solutions. They take the weight off partners’ shoulders by using the latest software for order picking and providing time-slot based delivery.

Dr Mária Törőcsik

managing director

Trend Inspiráció

In the afternoon work continued with presentations. Dr Mária Törőcsik, a professor at PTE’s Faculty of Business and Economics and managing director of Trend Inspiráció talked about the lifestyles of consumers today. She called attention to society’s horizontal segmentation – this now also exists in addition to the vertical one. From the presentation it also turned out that the relationship consumers have with digitalisation defines their lifestyles.

Katalin Neubauer

managing director

MNKSZ

Katalin Neubauer, general secretary of the Hungarian National Trade Association (MNKSZ) gave a presentation about the roles and opportunities of Hungarian retailers. MNKSZ was established in 2014 represents the interests of retail enterprises that are in full Hungarian ownership, trying to convince the government to treat these retailers as strategic partners. Ms Neubauer listed the steps retailers must take if they wish to retain or improve their market position.

Tünde Turcsán

client service

director, GfK

Tünde Turcsán, client service director of GfK spoke about what their research results communicate to FMCG retailers and product manufacturers. She also forecasted what kind of trends can be expected in Hungary.

Péter Mondovics

marketing manager

Mastercard

Mastercard’s marketing manager Péter Mondovics introduced the results of the company’s retail customer experience survey. He revealed that the best retail experience is when customer needs are satisfied throughout the whole customer journey, across digital and physical channels of retail. After the presentation Mr Mondovics handed over the awards to the winners of the Retailer of the Year competition.

Zsolt Gyelán

vice president

CBA

There was another roundtable discussion in the afternoon, this time analysing the state of play and what the future might bring for retail trade. The spotlight was on the situation created by discount supermarkets and the cooperation between distributors. CBA’s vice president Zsolt Gyelán opined that in Hungary retailers will only receive quality products from suppliers when there won’t be volume sales growth any more. He said that the biggest strength of discounters is efficiency, and they will keep expanding until consumers start to demand more from a shop and from products than what discounters can offer.

Gabriella Heiszler

managing director

Spar

SPAR’s managing director Gabriella Heiszler explained that quick shopping doesn’t just mean spending little time in a store, but also that the shoppers can get to the store quickly. Since SPAR shops are easy to access, in this respect they can compete with discount supermarkets.

László Szili

commercial director, Reál

László Szili, commercial director of Reál shared his view that Hungarian retailers must learn discounters’ capability to adapt, for instance they have started listing less cost-effective product categories, because they realised that shoppers want them, e.g. fresh bakery items.

Dr. István Rédei

member of the board of directors

CO-OP Hungary

Dr István Rédei, a member of the board of directors at CO-OP Hungary said the situation is simple: Shoppers go shopping where they can buy products with a good price-value ratio quickly. He revealed that CO-OP tries to win those consumers that like Hungarian products.

Péter Kurucz

retail services director

Nielsen

Péter Kurucz, retail services director of Nielsen believes that efficiency can lead to sales growth. At the moment the conquest of discount supermarkets doesn’t seem to stop. Nearly 80 percent of consumer still don’t buy FMCG products online – most of them because they like shopping, they want that experience.

Zoltán Tóth

managing director

Trafi k.hu

Zoltán Tóth, managing director of Dohánybolt Ellátó (Trafik.hu) expressed his opinion that discounters offer a discount shopping experience. He revealed that sales in the tobacco shop channel are growing faster than that of discount supermarkets – sales jumped 70 percent since 2017.

Csaba Zádor

operative director

National Tobacco Shop Cluster

Csaba Zádor, operative director of the National Tobacco Shop Cluster revealed that the average shopper spends 2 and a half minutes in a tobacco shop. In this period of time the top 5 non-tobacco product categories they purchase are beer, alcoholic drinks, soft drinks, energy drinks and coffee.

Gyula Vidács

president

Hungarian Franchise

Association

Gyula Vidács, president of the Hungarian Franchise Association called attention to the importance of standardisation for stores that operate as part of a network. Each product should appear in every unit at the same time, and with the same conditions.

Dr. Michalis Christou

CEO, RetailZoom

Europe

Dr Michalis Christou, RetailZoom’s CEO for Europe pointed it out: The market share of discounters indicates that there are shoppers who like efficiency, a limited product selection and fresh products, these consumers are shopping driven by rational decisions; and there are others, those that are looking for an experience.

Tibor Kujbus

Vásárló,

former managing director of Reál

Tibor Kujbus, managing director of Reál Élelmiszer Kft. for nearly two decades before February 2019 said: Consumers don’t care about the strategy or philosophy of retailers, they want to buy classic FMCG products quickly, and pay without wasting time, in stores that are not too large and easy to ‘navigate’.

Klára Tihanyi

exhibition director

Hungexpo

There were also two presentations in this section. Hungexpo’s exhibition director Klára Tihanyi called attention to the significance of and the opportunities created by the FMCG and HoReCa trade show Sirha Budapest 2020. Zoltán Tóth, the owner of DiginStore and TrafikTV’s operator spoke about how successful tobacco shops are in FMCG retail. Sales are growing very fast and POS communication tool TrafikTV reaches 100,000-120,000 customers a year. //

Related news

They want it to be premium, but also sustainable – expectations of the youngest generation

GlobalData’s latest report, “Demographics in Retail and Apparel” – which…

Read more >Lab-grown meat: the future of sustainable food production or a dead end?

In recent years, increasing attention has been paid to laboratory-grown…

Read more >AM: the Szupermenta product test program provides additional information for purchase

The National Food Chain Safety Office (Nébih) Szupermenta product test…

Read more >Related news

On self-acceptance, self-liberation and the gift of everyday life – We were learning together (Business Days 2024 Part 2)

On Friday at the Business Days conference it was all…

Read more >Brand footprint – or what do Coca-Cola, Kinder and Riska have in common?

The results of the Brand Footprint research coordinated by CPS-YouGov…

Read more >