RetailZoom: The surge of penetration in Domestic Chains – but what is behind it?

We have examined the changes in Domestic Chains and the shopping habits of its customers already from many aspects, now let’s look at those changes from another angel: basket penetration.

Basket penetration in general shows how many baskets contain products from a given category out of all the baskets/transactions of a shop during a given period. For example, a 5% basket penetration figure indicates that every 20th basket included at least one product from the concerned category. But how have these penetration figures changed for the various categories and what are the reasons behind? Let’s examine!

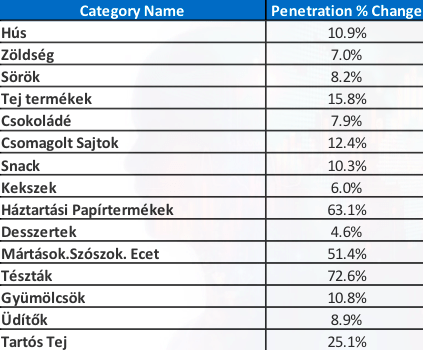

When examining the top 20 categories of March 2020, average basket penetration increased by over 21% vs the same period in 2019. It means that products from the mostly bought categories got into the baskets 21% more often. Among the highest jumps we find the obvious categories such as Pastas (+70%), Household Papers (+60%) or Frozen Vegetables (+51%). What could have caused these figures to jump that significantly?

First of all, there is the significant jump in Value Sales for these categories, as a result, products are more frequently bought by customers, that can have the biggest impact, in spite of customers preferring larger pack sizes. But there are other reasons as well: in one of our earlier articles, we have already demonstrated how the so-called “small (or impulse) baskets” have evaporated from the shops of the Local Chains, and being replaced by big baskets. This phenomenon has also driven the penetration figures as impulse baskets used to compromise strong penetration due to too few items being placed in such carts and thus lowering the importance of categories that would be part of larger baskets.

Finally, we have to cite a third reason as well, which is equally important in understanding the trends: we have also demonstrated what kind of role the “proximity” of the shops of the Local Chains have played in attracting new customers, as convenience has been a major factor for the customers in their store selection processes. This has generated many new customers for these shops, whose extra spending (mainly in the TOP categories) have meant another boost for the penetration figures. Thus, we see a huge surge in cleaning and household items, which was not usually the image of Domestic chains, however, convenience can over-rule most habits.

The exciting question is, that once the pandemic is over, which of the above factors will be able to keep these penetration figures at bay. Well, sales value figures have already started to slow down at the end of March. By knowing and understanding how customers shop in April and May will probably enable us to see how these changes might affect us long-term. As such, the biggest question for domestic chains will be how to maintain their new shoppers in the long run.

Related news

Gen Z Consumers ‘Behave Like Boomers’ When Grocery Shopping: Study

Some 59% of Generation Z consumers prefer to shop for…

Read more >How stable are the biggest companies in these turbulent times? Mol is on the podium again

Although the companies have recovered from the negative effects of…

Read more >RetailZoom: A dohányboltok ismét felülmúlják a piacot

A Business Days második napján Andreas Christou, a RetailZoom ügyvezető…

Read more >Related news

“To the bin with food waste” – the Nébih No Leftovers program announces a poster design competition

On the occasion of the Sustainability Theme Week, the program…

Read more >Paper packaging may not be the best

The environmental effects of packaging are receiving more and more…

Read more >Aldi to create 5,500 new jobs in the UK this year

In the UK Aldi is creating 5,500 new jobs as…

Read more >