RetailZoom: “Does Size Matter?” – how the size of domestic chains influence shopper experience

Since the pandemic, all domestic chains have sky-rocketed in sales. Large store formats (400-1000 m2) became trailblazers meanwhile XL store formats (1000 m2 – 2500 m2) such as Supermarkets and Hypermarkets were only following in their footsteps.

When looking at the first 3 weeks of March, it became clear that size is not everything. The trends of 2019 showcased that a variety of products to choose from was one of the main reasons for picking domestic chains along with the diverse variety in fresh products (meat, vegetables, fruits, dairy and bakery). As such, supermarkets and hypermarkets were leading all trends (sales, volume, basket value, products per basket, penetration) versus other store formats, however, since the COVID-19 outbreak, convenience trumps everything.

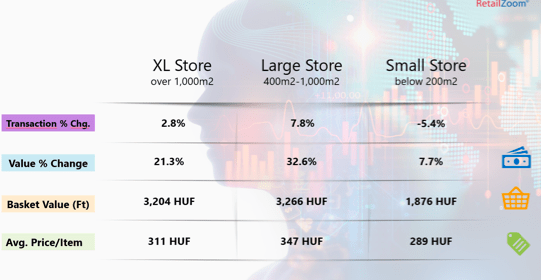

Convenience “stock-up” shopping resulted in large format stores increasing their sales by 32.6%, along with their transaction numbers by +7.8% and their average basket value from 2,576 to 3,266 HUF per basket. Moreover, their big basket shoppers now represent over 30% of their sales with 11% basket penetration. That means they have nearly tripled their number of “big shopping carts”, but not their revenue. As such these store formats now lead the trends in all of the above-mentioned performance indicators.

XL stores such as Supers and Hypers have also increased their sales by 21.3% in the first 3 weeks of March, which is a significant increase, just not as drastic as the “convenience shops”. The transaction numbers of XL stores have also slightly increased by 2.8%. Additionally, “Big baskets” worth 10,000 HUF or more, now make up 9.8% of Super/Hyper baskets and represent 26.7% of their sales.

One more fact that separates these store formats from each other is that Super and Hyper shoppers seems to be “bargain-hunters” as they place more products in their basket at an “economy” price, spending on average 369 HUF per item, meanwhile, large store formats actually place 2 less products in baskets worth 10,000 HUF or more but at an average price of 417 HUF per item.

With the emergence of “hoarders” and “bargain hunters”, it seems that consumers are evolving. Some “household” or cleaning products have drastically declined, washing powders & pods by 33.9%, meanwhile detergents by 45.3%. This means that with people spending more and more money they had to adapt and as such some had to become more “price savvy”. Intrinsically, they buy cleaning products or any other expensive items from drudgeries, or wherever they can get it from cheaper.

Related news

How stable are the biggest companies in these turbulent times? Mol is on the podium again

Although the companies have recovered from the negative effects of…

Read more >István Nagy: if necessary, the government will ban the import of Ukrainian grain products under national authority

The government will protect Hungarian farmers and, if necessary, from…

Read more >MTÜ: the number of visitors to Balaton in July exceeds the numbers before the coronavirus epidemic

So far, there have been more than 700,000 guests at…

Read more >Related news

Twenty years in the EU: how has Hungarian consumption changed?

On 1 May 2004 ten new member states joined the…

Read more >Carefree consumers? Considerable differences in the middle-aged camp

Although inflation receded, the income of middle-aged people did not…

Read more >18+! Will cola be next after the energy drink?

According to the new regulations coming into force in Hungary,…

Read more >