Magazine: The pandemic is transforming the food industry

Our magazine interviewed Tamás Éder, president of the Federation of Responsible Food Manufacturers (FÉSZ).

![]() With what results did the food industry close 2019?

With what results did the food industry close 2019?

Tamás Éder

president

Federation of Responsible

Food Manufacturers

– The volume of production in the food industry – including the results of the tobacco and alcoholic drink segments – grew by more than 5 percent. Domestic sales growth stayed below 3 percent, but export increased by more than 7 percent. Most categories were characterised by a balanced performance.

![]() How did the profitability of the food industry develop?

How did the profitability of the food industry develop?

– We don’t have data about this yet, as the companies are preparing their reports only now. Based on market information I can say that the sector’s profitability was about the same in 2019 as in 2018.

![]() Which were those sectors that had to face bigger challenges?

Which were those sectors that had to face bigger challenges?

– Last year was brutal for the fresh meat and meat product sector, due to the increase in meat production costs and the swine flu. In just one year the price of live pig elevated by nearly 50 percent in Hungary.

![]() Were there any regulation issues or problems in the world market that had a negative influence on the sector?

Were there any regulation issues or problems in the world market that had a negative influence on the sector?

– Two things definitely had an impact on the sector last year: the slight increase in the public health product tax (NETA) and its extension to new product categories, e.g. pálinka, where from 1 January 2019 the tax burden on some products surpassed 50 percent. As for the world market, China showed a bigger demand for pork than ever before.

![]() What did FÉSZ do to support the food industry in 2019?

What did FÉSZ do to support the food industry in 2019?

– FÉSZ was established one year ago, transforming from ÉFOSZ. We launched a programme called Hello Food, which seeks to freshen up communication about the sector. Primarily FÉSZ does classic interest representation work, studying draft regulations and lobbying for modifications if necessary. We continue our battle for cutting the VAT on the most important food products, and we keep saying that the NETA can’t achieve the goals it was introduced for, therefore it should be abolished.

Recent steps taken to whiten the economy have brought about positive changes

![]() What about the ‘whitening’ of certain segments of the food industry?

What about the ‘whitening’ of certain segments of the food industry?

– It can be seen clearly that steps such as the mandatory online connection of cash registers and the Electronic Public Road Trade Control System (EKÁER) had a whitening effect on the food industry in the last 5-6 years. Still, the biggest step forward was cutting the VAT: those food industry segments are the whitest where the VAT rate is 5 percent.

![]() Which problems need solving at the moment?

Which problems need solving at the moment?

– FÉSZ opines that the majority of Hungarian food companies are less developed technologically than the requirements of the 21st century would make it necessary. I think that the current pandemic situation will accelerate the development process in this domain, with new investments in digitalisation, automation and robotics.

Most undertakings in the sector are in need of significant capital raising to become competitive

![]() How much did the coronavirus pandemic change plans for 2020? As president of FÉSZ, what is your experience: what kind of effects has the pandemic had and how will it influence the sector in the future?

How much did the coronavirus pandemic change plans for 2020? As president of FÉSZ, what is your experience: what kind of effects has the pandemic had and how will it influence the sector in the future?

– In the last few weeks, online grocery sales were growing faster. One of the biggest lessons companies learned is that product ingredients, additives and packaging materials should be purchased from closer geographical locations than in the past. The food industry will undergo a consolidation process, and the longer the current special situation is, the more market players will be unable to survive. We hope that the financial support from the government will be enough for the majority of enterprises to stay on their feet. //

Related news

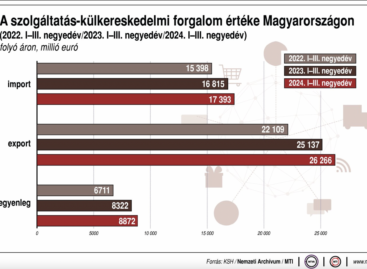

Foreign trade surplus in services was 3.5 billion euros in the third quarter

In the third quarter of 2024, exports of services in…

Read more >Supplier and buyer goals align, but challenges and plans vary by channel – We were learning together (Business Days 2024 Part 1)

From Tuesday the students of the FMCG Open University had…

Read more >Related news

On self-acceptance, self-liberation and the gift of everyday life – We were learning together (Business Days 2024 Part 2)

On Friday at the Business Days conference it was all…

Read more >Brand footprint – or what do Coca-Cola, Kinder and Riska have in common?

The results of the Brand Footprint research coordinated by CPS-YouGov…

Read more >