The strength of brands

On Thursday Gábor Tolnai, head of the marketing insight division at Kantar Hoffmann gave a presentation at the Business Days conference.

Gábor Tolnai

head of marketing insights division

Kantar Hoffmann

He shared the results of their global survey, which analysed 26,000 brands in 90 FMCG categories, in 52 countries on 5 continents.

This Brand Footprint report uses the Consumer Reach Points (CRP) index to tell how strong brands are: the index shows how many shoppers choose a given brand, and how many times instead of another one. In Kantar Hoffmann’s special research, every FMCG brand competes against others in the given category.

The CRP index is calculated by taking the number of households in a country, and checking what percentage of households buy a given brand, and how many times they do it. For instance in 2021 in Spain 17.8 million households purchased Coca-Cola with a 71% ratio, 10 times a year, so the brand’s CRP index was 132 million in Spain.

A decade of boom

“In the last 10 years the FMCG sector expanded by a stunning USD 650bn, which represents a 33% growth. As the Earth’s population is growing, the number of households was up 17% in this period, so there were more shoppers too. In this 10-year period the number of brand choices increased from 329 billion to 382 billion. This 16.2% growth was practically just as big as the population growth. Spending on brands per household grew from USD 730 to 862. Each year 25 brands became stronger in the Top 50. This is the only number that didn’t change during the 10 years” – informed Gábor Tolnai.

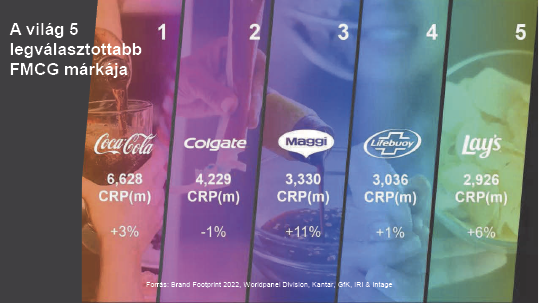

Coca-Cola is the global leader brand

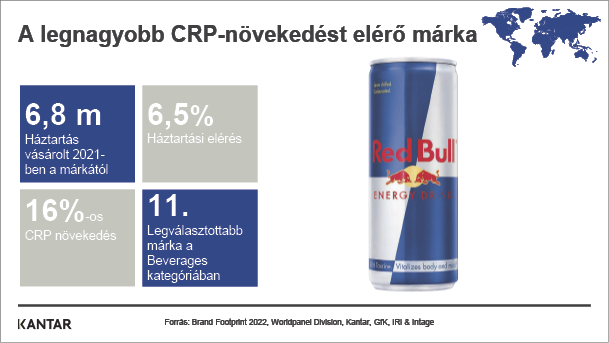

Kantar Hoffmann’s research found that there were 416 billion global FMCG brand choices in 2021, 1.4% more than in 2020. The most frequently chosen global FMCG brand was Coca-Cola, followed by Colgate, Maggi, Lifebuoy and Lay’s. It is noteworthy that food brands are the strongest in basically every country, with the exception of Bangladesh, where a cosmetics brand is the number one. Last year Maggi was the fastest-growing brand in terms of penetration in the Top 50, thanks to the number of its buyers increasing by 33%. Red Bull produced the biggest CRP growth, 16%, but this still wasn’t enough to enter the Top 50.

Kinder is Hungary’s most popular brand

Hungary’s most popular brand became Kinder and Coca-Cola was the runner-up; Mizo, Milka and Pöttyös also made it into the Top 5. This ranking is the same as it was in 2020. Unlike in the global Top 25, there are almost exclusively – Zewa is the only exception – food brands on the Hungarian list of the Top 25 brands. It is also a Hungarian peculiarity that an alcoholic drink brand could enter the Top 25.

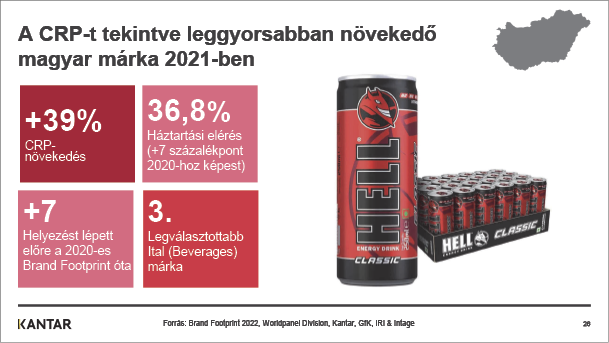

Hell produced the biggest CRP growth, 39% in Hungary. This took the brand two places up in the Brand Footprint ranking. Behind them Xixo, Dreher, Apenta and PICK produced the biggest CRP growths. Mr Tolnai told: data from the past few years make it clear that not only major international brands can become the most chosen ones.

//

This article is available for reading in Trade magazin 2022.12-01

Related news

Coca-Cola, Grab strengthen partnership to engage hybrid shoppers in SEA

It includes regional campaigns across both online and offline channels.…

Read more >Coca-Cola Launches Initiative To Bolster Retailers In India

Coca-Cola India has announced a new support programme for small…

Read more >HELL ends the year with an award

In addition to having several market-leading brands and export activities…

Read more >Related news

They want it to be premium, but also sustainable – expectations of the youngest generation

GlobalData’s latest report, “Demographics in Retail and Apparel” – which…

Read more >Zsolt Liptai became the winemaker of the year

The Hungarian Wine Academy (MBA) has awarded Zsolt Liptai, the…

Read more >Tips for avoiding credit card fraud during the holiday season

The Christmas season is all about the joy of shopping,…

Read more >